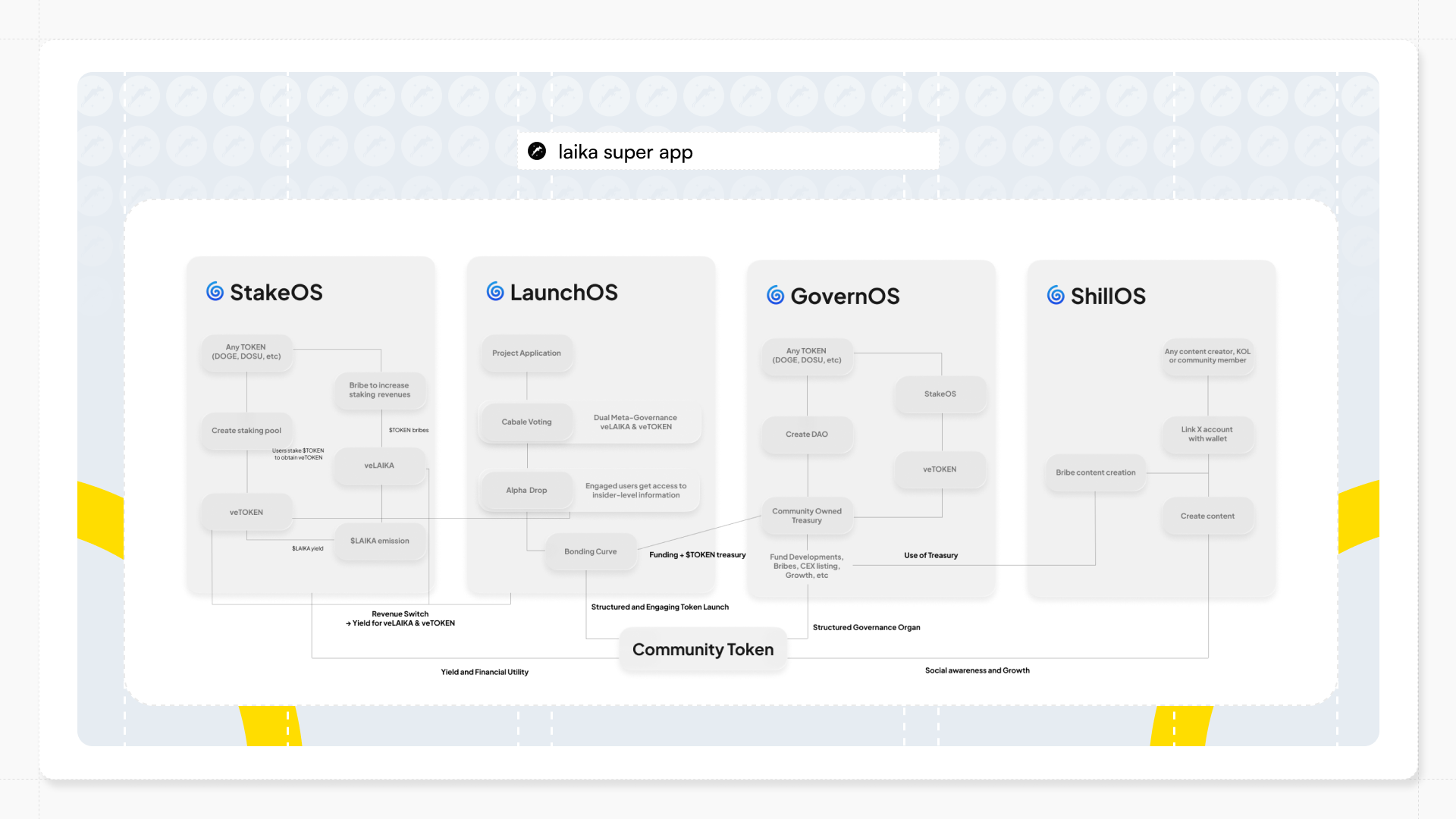

Governance Model

Dual-layer, time-weighted, execution-first.

Protocol coherence is steered by veLAIKA; project sovereignty runs on veTOKEN. Macro rails stay consistent while each community operates its own economy.

Separation of concerns

Protocol (veLAIKA): StakeOS gauge weights, global params (bribe windows/caps, bonding-curve presets, DAO activation rules), LaunchOS curation, protocol treasuries.

Project (veTOKEN): local treasury spend, incentive schedules, bribe strategy, ShillOS budgets, upgrades/integrations.

Quick reference — locking parameters

Minimum lock

30 days

30 days

Maximum lock

4 years (1,460 days)

4 years (1,460 days)

Voting power formula

vePower = amount × 0.8 × (duration_days / 365)^1.322, capped at 5 × amount at 4 years

vePower = amount × 0.8 × (duration_days / 365)^1.322, capped at 5 × amount at 4 years

Early exit

penalty = amount × (remaining_days / total_days)

penalty = amount × (remaining_days / total_days)

↝ Notes

The convex curve (exponent 1.322) rewards longer commitments more than linearly; the 0.8 factor calibrates the 1-year point.

ve-assets are non-transferable; voting power decays as the lock approaches expiry. Extend/rel-lock to maintain vePower.

Early-exit penalties are forfeited per policy (default: burned).

↝ Examples (veLAIKA)

1,000 LAIKA locked

30d → ~29 veLAIKA

90d → ~126 veLAIKA

180d → ~314 veLAIKA

365d → 800 veLAIKA

2y → ~2,000 veLAIKA

4y → 5,000 veLAIKA (cap)

Early exit: lock 1,000 for 180d, exit at 90d → penalty = 1,000 × (90/180) = 500 forfeited; 500 returned; veLAIKA expires.

Governance flows

veLAIKA holders

Allocate weekly StakeOS emissions (gauges).

Curate LaunchOS (commit–reveal; winner only revealed).

Set protocol-wide params & fee routing schedules.

Receive: proportional protocol revenue + bribes (epochic settlement).

veTOKEN holders

Run their DAO (treasury, incentives, campaigns, upgrades).

Tune bribe posture to attract veLAIKA votes to their pool.

Receive: $LAIKA yield when their pool is funded + project-level distributions.

Participate in LaunchOS curation (where enabled).

Rewards and distribution

Staker rewards are proportional to commitment:

This routes more value to organized, long-duration communities—not to mercenary TVL.

Secret curation (LaunchOS)

Commit–reveal with no interim tallies; only the winner is shown.

Reduces sniping & metagaming; losing projects aren’t publicly exposed and can reapply.

Aligned voters may receive alpha windows (policy-gated allowlists).

Vote-to-earn incentives

Bribes: any token can be posted to influence veLAIKA/veTOKEN direction; payouts pro-rata to supporting voters.

LaunchOS alpha: early TGE intel/allowlist for aligned voters (per policy).

StakeOS perks: enhanced multipliers or protocol top-ups to winning pools.